There has been a big fall in landlords using 'no fault' eviction notices in repossession cases, research reveals.

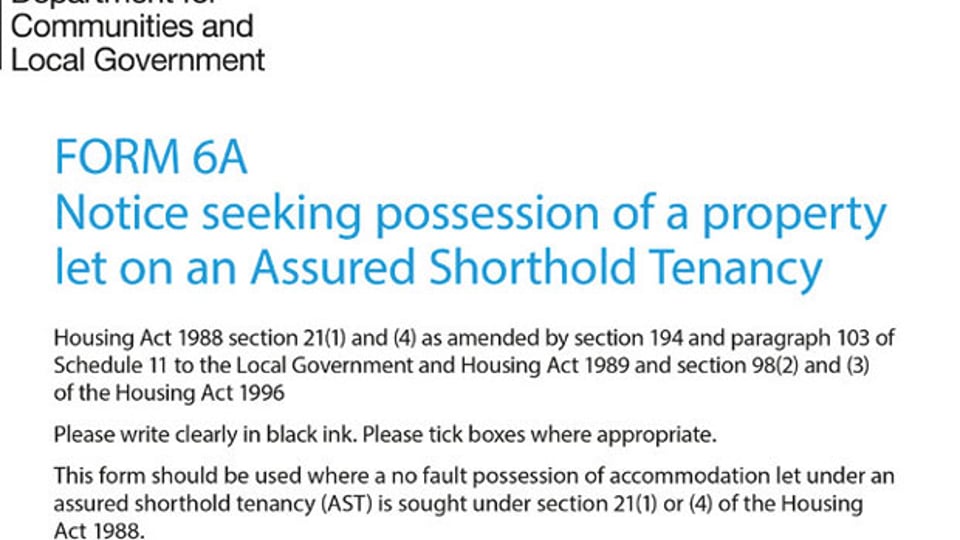

The National Residential Landlords' Association (NRLA), says it has analysed government data for England and Wales to reveal that Section 21 possession cases are down by 50% in the third quarter of this year, compared with 2019.

They say this underlines a trend that has seen Section 21 repossession cases falling between 2015 and 2019 by 50%.

The Renters Reform Bill proposes to abolish Section 21 notices but has been delayed until next year.

That's because the government says that ministers need more time to consider a National Audit Office report that is set to be published into renting regulations.

New measures for the private rental sector

The White Paper will deliver new measures for the private rental sector, including reforms to boost living standards, a national landlords' register and a lifetime tenancy deposit model.

The Renters Reform Bill was first unveiled nearly two-and-a-half years ago and the NRLA has called previously for the replacement of Section 21 notices with a new system.

They say that the system should include comprehensive and clear grounds for landlords to repossess legitimately their property.

They also want the repossession process to be quicker.

That's because, the NRLA says, it takes a landlord 59 weeks on average to repossess their property.

Drop in Section 21 notices being used in repossession cases

The NRLA's chief executive, Ben Beadle, says that the drop in Section 21 notices being used in repossession cases should help ‘dispel the myth’ of landlords wanting to evict a tenant for no reason.

He said: "While we condemn landlords who abuse the system, it's vital to remember that the majority of landlords and tenants enjoy a good relationship."

However, Ministry of Justice (MoJ) figures reveal an increase in the number of landlord repossessions taking place.

And while evictions were banned in March 2020 because of the Covid-19 pandemic, they restarted in September last year though bailiff-enforced evictions were restricted.

According to the MoJ's figures, between July and September there were 4,853 landlord repossessions - that's three times more than in the previous quarter.

Though these figures are lower than typical quarterly possession case numbers.

'Delay to the Renters Reform Bill is a regret'

The managing director of Accommodation for Students, Simon Thompson, said: "The delay to the Renters Reform Bill is a regret because landlords and letting agents would know what the plans were for using no fault notices.

"Until the Audit Office publishes their report, we will have to wait to see what the plans for landlord repossessions are but until then we have to use a system that may yet be scrapped and puts landlords in a bad light - regardless of the reasons they are evicting a tenant."

The potential repeal of Section 21 eviction notices under the Renters Reform Bill has split tenants and letting professionals, a survey has revealed.

In a recent report from Goodlord and Vouch, a referencing and prop tech company, they reveal that 38% of tenants believed that repealing 'no fault' evictions would have a positive effect on the private rented sector.

However, just 8% of letting agents believe the change would be positive.

Removal of 'no fault' eviction notices would be negative

Indeed, 30% of agents say that the removal of 'no fault' eviction notices would be negative, compared with 5% of tenants.

In the same report, the 'State of the Lettings Industry', they also found that 64% of letting agents believe that landlords will leave the PRS in the coming year.

Of those questioned, 83% said that they had already seen landlords leave over the past year, with most agents seeing between 1% and 19% leaving.

Also, the reports adds that some buy to let brokers are reporting that smaller landlords are selling their properties because of rising property prices - but there are suggestions that these properties are being bought by portfolio landlords who are looking to expand.

The report reveals that the reasons for landlords exiting the sector include costs, yields, tax changes and their return on investment.